| Sl.No | Topics | No of Classes | Hours(2 hours/ class) |

|---|---|---|---|

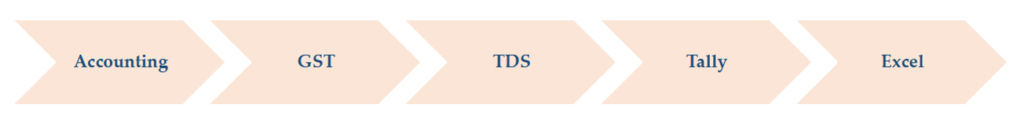

| Ice Breaking – Interaction | 1 | 2 | |

| 1 | Accounting | 4 | 8 |

| 2 | Goods and Service Tax (GST) | 3 | 6 |

| 3 | Income Tax -TDS | 2 | 4 |

| 4 | Tally | 3 | 6 |

| 5 | Excel | 2 | 4 |

| 6 | Evaluation | 1 | 2 |

| Total | 16 | 32 |

Godrej Genesis | Room No 907 | 9th Floor | Street Number 18 | Block EP & GP | Sector V | Bidhannagar | Kolkata-700 091

+91-33-4850-0604 | +91-33-4850-0608